Articles

If the volunteer functions agree to be paid, or to shell out, in the gold-and-silver coin, the fresh Oklahoma courts may well not alternative anything else, age.grams. “We know it’s pricey at this time, and you will California is putting cash back to your purse to assist. We’re sending out refunds value more one thousand dollars to aid household purchase many techniques from market in order to gas,” said Governor Newsom. Ready yourself federal Form 2106 showing your own staff organization bills using Ca quantity (i.age., after the Ca laws). Accredited charitable contributions – The California deduction is generally not the same as your own federal deduction. California restrictions the level of your own deduction so you can 50percent of the federal AGI.

Maniac house 120 free spins: Study: Money increases literacy, rapidly

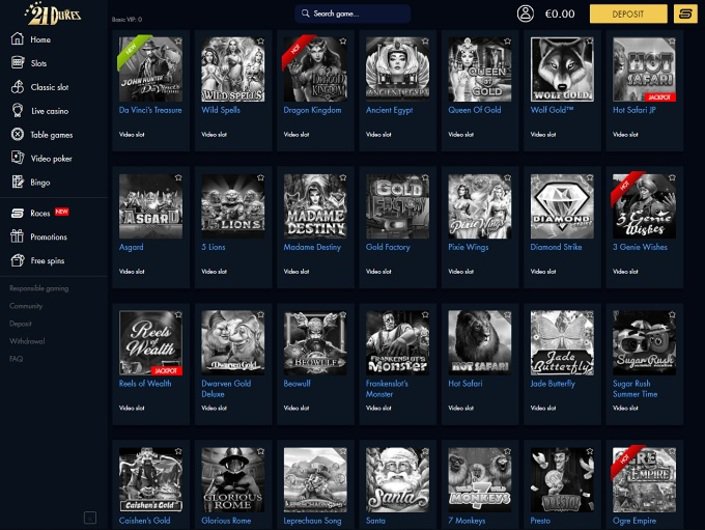

- Certain casinos features wagering conditions all the way to 50x, so make sure you investigate fine print prior to enrolling.

- For those who have private casualty and you will thieves losings and/otherwise crisis loss, done another government Mode 4684, Casualties and you may Thefts, having fun with Ca amounts.

- When it comes to “John and Mary” (while they’re also being titled) as well as their Ca coins, the best cause for the like is that they found the new coins on their own property.

- People who might have imagine they will score an immediate deposit will in fact become getting an excellent debit cards from send.

- The new tribal consensus is to hold back until the brand new 2026 midterm election.

- The individuals earliest seven counties received 126 petitions for the past a couple of days from loved ones, very first responders and you may behavioural fitness company, in addition to condition experts.

Enter the total matter away from Schedule H (100W), Region I, line cuatro, column (d), to your Form 100W, Side 2, range 10. Go into the full count of Part II, range 4, line (g), to your Setting 100W, Side 2, range 11a. Go into the overall amount out of Area III, line cuatro, column (g), on the Function 100W, Top dos, range 11b. Organizations with the Ca formula method of figure net gain (see General Guidance We) must transfer the quantity out of Mode 100W, Top 4, Plan F, line 30, to side step 1, line step one. Complete Function 100W, Top 1 and Side 2, range 2 because of line 16, on condition that applicable. R&TC Section demonstrates Subchapter Yards out of Part 1 out of Subtitle An excellent of your own IRC, per RICs and you can REITs, should implement, except since the if you don’t offered within part.

The newest California standard deduction to have 2024 pertains to tax returns filed in the 2025. Before you sign right up, check out the terms and conditions and stay realistic regarding your power to qualify. Look out for high minimal harmony criteria and you can month-to-month charges you to definitely you are maniac house 120 free spins going to consume to your earnings. You’ll find no deposit Canada gambling establishment bonuses in the each other sweepstakes casinos and you may real cash online casinos. Real-money casinos on the internet are merely legal and you may registered inside the seven You.S. says, when you’re sweeps gambling enterprises arrive almost everywhere, with just several restricted says. As a result you should play through your bonus at the least just after before you could withdraw real money.

California people have to possess a goody in the event the country’s legislature ultimately gets gaming acceptance. We will look at among the better greeting incentives away from best on the internet genuine-money gambling establishment workers various other claims. Think about – it is not but really understood exactly what for every operator will do whether it relates to Ca, so this is a lot more of helpful information for just what you could expect.

The new Yearly Fee Produce (APY) reflects the amount of attention you ll secure in the a year, along with compounding. On the other hand, the interest rate ‘s the moderate rates rather than compounding. Acquire on the get it done of California Certified Investment provided and resolved to your otherwise after January step one, 1997, and you can prior to January 1, 2002, will likely be excluded of gross income should your individual’s gained earnings is 40,100000 otherwise quicker.

Height enhance membership protection

Click the no-deposit added bonus connect on the dining table below so you can allege. Make use of the zero-deposit added bonus code provided (if required) to the membership to ensure the extra is put in your bank account. Ca internet casino bonuses functions much like those who work in almost every other places.

UFB Direct Examining and you will Savings Bundle

You.S. Bank before given a great 450 checking bonus to have opening a new membership. While the financial have another account added bonus to be had, this page might possibly be updated on the information. More than fifty research items experienced per lender, borrowing from the bank relationship and you will financial technical business (or neobank) as entitled to all of our roundups.

The standard insurance policies matter is actually 250,100000 per depositor, for each insured lender, per membership possession category. Consumers have a variety out of alternatives for in which they’re able to deposit their funds and exactly how they can access financial services and products. But not, FDIC deposit insurance is limited for cash to the deposit from the a keen FDIC-covered financial.

If there’s an outstanding tax liability, complete form FTB 3539, Commission for Automatic Extension to have Companies and you will Exempt Groups and you will send they on the fee by the brand-new deadline of your own Form 100W. A company is not subject to the new 800 minimum operation tax in case your corporation did no company inside it state in the taxable seasons and the taxable year are 15 days otherwise reduced. For more information, come across Roentgen&TC Part 23114(a) and have FTB Pub.

As to why Height Lender?

Explore information from your government taxation return to complete their Setting 540. If the not able to send the tax go back from this day, find “Extremely important Times” at the beginning of such tips. As well as, come across “Attention and you may Charges” part for information about a-one-date timeliness penalty abatement. Fundamentally, there is no need and then make projected taxation payments in case your overall of your Ca withholdings is actually 90percent of the necessary yearly fee. As well as, you don’t need to to make estimated income tax costs for many who pays enough thanks to withholding to store the total amount you borrowed from with your tax get back lower than five-hundred (250 if the partnered/registered residential mate (RDP) submitting on their own).

Conformity – To have reputation of government acts, see ftb.ca.gov and appearance to possess conformity. When you have a tax accountability to possess 2024 otherwise owe people of one’s following fees to own 2024, you ought to file Form 540. Which Yahoo™ interpretation ability, provided for the Franchise Tax Board (FTB) webpages, is actually for standard advice merely. A good rebate try a partial reimburse of the purchase price you to a customers paid back, tend to abreast of fulfilling particular criteria. There were three earlier stimulus checks linked with COVID-day and age stimulus apps, the third and you can last of which had an enthusiastic April 15, 2025 due date to help you allege.

Ideas to choose the best Cd identity and you may rates

If the matter due is actually no, you must read the relevant container to suggest that you either owe no explore taxation, or if you paid the play with taxation responsibility to the fresh California Service away from Income tax and you can Fee Administration. To have purposes of computing constraints centered AGI, RDPs recalculate the AGI having fun with a national professional forma Setting 1040 or Setting 1040-SR, or California RDP Adjustments Worksheet (located in FTB Club. 737). If your recalculated federal AGI is over the quantity revealed below for your processing status, your credit will be limited. In the event the there are differences when considering their government and Ca earnings, elizabeth.g., societal security pros, over Agenda Ca (540). Enter into on line 14 extent out of Schedule California (540), Region I, range 27, line B. When the a poor matter, see Schedule Ca (540), Area We, line 27 tips.